Domain Info

What people think about EECU Credit Union?

Average banking experience with great friendly staff

Miss Lexi Beahan III

Horrible products that EECU offers.

Hipolito Ryan

She waited for his return call, but it never came.

Mr. Tevin Olson II

Important

The previous three items charactirize a definite financial institution. But below you can find general information about payday loans.

Payday Loans in Fort Worth, Texas

Payday loans are short-term loans originally invented to tide people over until payday. You can usually borrow from $100 to $1,000.

It is effortless and speedy to get approved for payday loans in Fort Worth, Texas. The APR will be set specifically for each applicant and will depend on the personal details the borrower provided.

can exceed 400%

Not Specified (on average $800)

7 days

180 days

Advantages of EECU Credit Union that offers payday loans in Fort Worth, Texas

- Apply around the clock. You can use the online service 24/7. The necessary funds will be deposited to your bank account as soon as possible. You won't be asked to come to the lender’s store.

- Only a few documents are required. Payday loans are very easy to access. You an ID and proof of income. Wages and tax statement are not required.

- Online process. You can finalize the application from the comfort of your home. If approved, the money will be transferred to your bank account the same day or the next day.

- Loan rejection is almost excluded. 94% of applicants are accepted for a maximum loan amount.

- Bad credit is accepted. Not all customers are able to get a bank loan due to bad credit. Previous delays in loan repayment won't prevent you from getting accepted for a cash advance.

Information needed to complete a loan application

As soon as you fill out an application, submit it and recieve the offer.

Payday loans for bad credit

A poor credit score doesn't have to prevent you from applying for payday loans. They are one of the few unsecured loan products available to clients with a poor credit rating. Payday loan approvals depend very much on other circumstances. Lenders will pay attention to your earnings and subtract all your expenses. Usually, your score won’t be affected by a payday loan, as long as you repay it in full and on scheduled.

To get approved for a payday loan, you have to comply with the following requirements:

- be 18 years old or older;

- be a U.S. citizen or permanent resident;

- be employed and have a steady income;

- have a valid checking account in your name;

- have an email address and phone number.

Rate Your Credit Score

- No ability to get a loan

- No ability to rent a room

- 80% of loan approval

- Apply for all loan types

- 95% of loan approval

- Apply for all loans including mortgage

Other Payday Lenders in Fort Worth, Texas

PlainsCapital Bank

7925 N New Braunfels Ave, San Antonio, TX 78209, USA

+1 (210) 804-7603

www.plainscapital.com

Armed Forces Bank

1617 Pleasonton Rd Suite G-109, Fort Bliss, TX 79906, USA

+1 (915) 562-5454

www.afbank.com

Hancock Whitney Bank

555 Dowlen Rd, Beaumont, TX 77706, USA

+1 (800) 448-8812

www.hancockwhitney.com

Security Finance

2143 E Houston St, San Antonio, TX 78202, USA

+1 (210) 226-5297

www.securityfinance.com

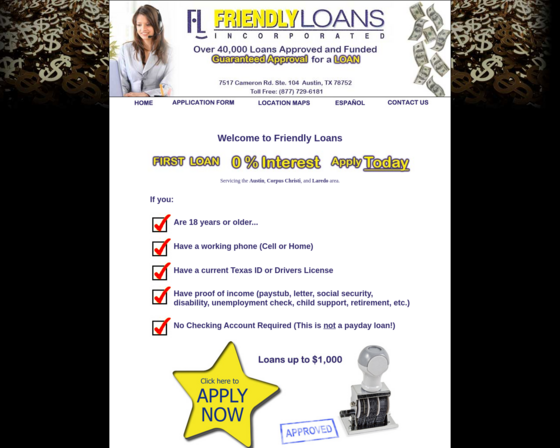

DEL MAR FINANCE

4812 Ayers St, Corpus Christi, TX 78415, USA

+1 (361) 853-8200

www.friendlyloansonline.com

Business Financial Consultants of Houston

7500 San Felipe St #600, Houston, TX 77063, USA

+1 (713) 706-6124