Domain Info

What people think about Walmart Money Center?

I borrowed $400 for a period of 11 days. In the end, I had to pay off twice as much with all the fees charged.

Miss Gabrielle King DVM

I took loans from Walmart Money Center many times. Previously it was ok. Last time they said I was eligible. Promised the money would be in my account within 7 hours. It’s been three days – no money. They do not answer phone calls. Why???

Jaron Hartmann

Applied for a payday loan second time. Got refused! No idea WHY! No explanation. Suspicious lender.

Elta Gerlach

Applied for a cash advance second time. Got denied! No suggestion WHY! No explanation. Tricky lender.

Barbara Kshlerin

Important

Below you can review general information about payday loans and their common characteristics.

Payday Loans in College Station, Arkansas

Payday loans are short-term loans originally created to tide people over until payday. You can usually borrow from $100 to $1,000.

Payday loans in College Station, Arkansas is are easy to access. The APR is specific for each applicant and depends on multiple aspects: age, income, loan amount needed, loan term, credit score, etc.

17% usury cap

Advantages of Walmart Money Center that offers payday loans in College Station, Arkansas

- Day and night service. This means you can apply from the comfort of your home. You won’t have to go anywhere to finalize your application or receive funds. The funds will be sent to your bank account the same day or the next day.

- Collateral is not needed. You only need to meet the basic eligibility criteria. You only need to provide some proof of income as well as valid identification. Bank statements and letter from employer are not needed.

- Application is purely online. It only takes a couple of minutes to submit the form. The funds are transferred to your account as quickly as possible.

- 94% of applicants accepted. Almost all people are eligible for payday loans.

- Bad credit is ok. If you apply for a bank loan with poor credit, you are unlikely to get accepted. Banks only accept good credit. Payday companies do not pay attention to your credit and previous mistakes. You are likely to get approved in any case.

Information needed to complete a loan application

Submit your application to get a loan offer, then review its terms and rates.

Payday loans for bad credit

If you have a bad credit history you may still apply a payday loan. Such loans are created to help meet the needs of consumers with lower credit scores. There are companies who may be willing to offer you a payday loan even if you have a poor credit score. You will need a stable income to be eligible for a bad credit payday loan.

To get approved for a cash advance, you must meet the following eligibility criteria:

- be 18 years old or older;

- be a U.S. citizen or permanent resident;

- be employed and have a steady income;

- have a valid checking account in your name;

- have an email address and phone number.

Rate Your Credit Score

- No ability to get a loan

- No ability to rent a room

- 80% of loan approval

- Apply for all loan types

- 95% of loan approval

- Apply for all loans including mortgage

Other Payday Lenders in College Station, Texas

Fort Worth Community Credit Union - North Richland Hills Office

8524 Davis Blvd, North Richland Hills, TX 76182, USA

+1 (817) 835-5000

www.creditunionnorthrichlandhills.com

FirstCapital Bank of Texas

805 W Main St Suite 500, Fredericksburg, TX 78624, USA

+1 (830) 613-3628

www.fcbtexas.com

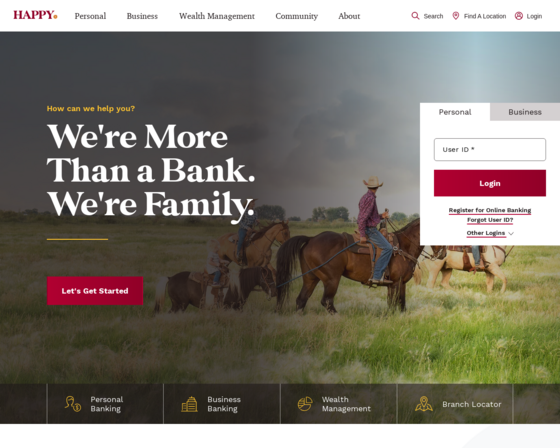

Happy State Bank ATM

1499 W South Loop, Stephenville, TX 76401, USA

+1 (800) 447-2265

www.happybank.com

Woodforest National Bank

6616 FM 1488 Road, Magnolia, TX 77354, USA

+1 (936) 321-5114

www.woodforest.com

Navy Federal Credit Union

8639 TX-151, San Antonio, TX 78245, USA

+1 (888) 842-6328

www.navyfederal.org

Security Service Federal Credit Union

545 N Americas Ave, El Paso, TX 79907, USA

+1 (800) 525-9570

www.ssfcu.org

Power Finance Texas

1900 George Dieter Dr, El Paso, TX 79936, USA

+1 (915) 856-4444

www.powerfinancetexas.com