Domain Info

Mailing Address

5335 Gate Parkway care of Network Solutions PO Box 459

Jacksonville

FL

32256

United States

What people think about Huntington Bank?

Thanks!! The money were sent to my bank account as promised – within 3 hours. I paid off the loan in a timely manner and had no problems. The process is trouble-free and transparent. Be a responsible client and you will have no issues.

Sharon Keebler

Huntington Bank seems safe. At least they have no hidden fees. This was the only lender that accepted me for a cash advance.

Dr. Paris Weissnat IV

Thanks!! The money were sent to my bank account as promised – within 3 hours. I paid off the loan in a timely manner and had no problems. The process is trouble-free and transparent. Be a responsible client and you will have no issues.

Sharon Keebler

Huntington Bank seems safe. At least they have no hidden fees. This was the only lender that accepted me for a cash advance.

Dr. Paris Weissnat IV

Thanks!! The money were sent to my bank account as promised – within 3 hours. I paid off the loan in a timely manner and had no problems. The process is trouble-free and transparent. Be a responsible client and you will have no issues.

Sharon Keebler

Huntington Bank seems safe. At least they have no hidden fees. This was the only lender that accepted me for a cash advance.

Dr. Paris Weissnat IV

Important

The above-given information provides the details about a peculiar financial institution. The information below is about general information about payday loans.

Payday Loans in Sebring, Florida

A payday loan is an unsecured loan — typically $100 to $1,000 — that's must be repaid + interest as soon as you get your next paycheck. Terms typically do not exceed 30 days.

Cash advance loans may become an easy and fast solution to a short-term problem in Sebring, Florida. Loans from payday lenders can get you funds same day. Your APR will depend on a few factors.

304%*

$500 for single payment and $1,000$ for installment loans

7 days for single payment and 60 days for installment loans

31 days for single payment and 90 days for installment loans

Advantages of Huntington Bank that offers payday loans in Sebring, Florida

- 24/7 application. This means you can apply and get funds at any time. Funds are deposited into your bank account immediately, so you do not need to visit to the lender’s office.

- No paperwork. You will only be asked to have basic documents. In most cases, you will only need an ID. Paystubs are not required.

- Online application. Your request will be considered much faster than in other financial institution. Funds are transferred to your account within several hours.

- High approval rates. 94% of applicants are accepted.

- Any credit welcomed. Banks reject applicants with bad credit. But payday companies are ready to help people with any credit score.

Information needed to complete a loan application

Then click “Submit” and wait for approval.

Payday loans for bad credit

A low credit score doesn't have to prevent you from applying for payday loans. They are one of the few short-term loan products available to applicants with a bad credit history. Payday loan approvals depend very much on other factors. Payday companies will pay attention to your earnings and subtract all your expenses. Usually, your score won’t be ruined by a payday loan, as long as you repay it in full and on scheduled.

To get approved for a payday loan, you must meet the following eligibility criteria:

- be 18 years old or older;

- be a U.S. citizen or permanent resident;

- be employed and have a steady income;

- have a valid checking account in your name;

- have an email address and phone number.

Rate Your Credit Score

- No ability to get a loan

- No ability to rent a room

- 80% of loan approval

- Apply for all loan types

- 95% of loan approval

- Apply for all loans including mortgage

Other Payday Lenders in Sebring, Ohio

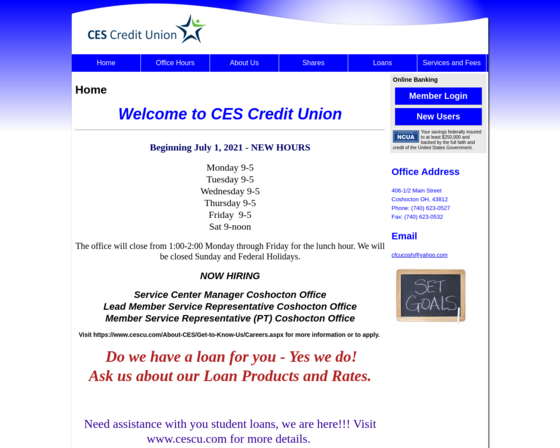

Coshocton Federal Credit Union

406 Main St #5, Coshocton, OH 43812, USA

+1 (740) 623-0527

coshoctonfcu.com

First National Bank in New Bremen

204 W State St, Botkins, OH 45306, USA

+1 (937) 693-1537

firstnbank.com

Yorkville Community Federal Credit Union

307 Public Rd, Yorkville, OH 43971, USA

+1 (740) 859-4922

www.yorkvillefcu.org

Montana Capital Car Title Loans

3349 Needmore Rd, Dayton, OH 45414, USA

+1 (937) 707-6229

montanacapital.com

Edward Jones - Financial Advisor: Kimberly J Betz

115 S 3rd St, Marietta, OH 45750, USA

+1 (740) 374-2196

www.edwardjones.com