Domain Info

What people think about Citizens Bank?

I always use Citizens Bank when it need a cash advance. The application process is easy. No complaints.

Dr. Oswald Davis

I asked Citizens Bank for financial assistance. Everything was done very quickly. Had the money in my account the same morning. Employees are very nice. Best experience!

Nathan Ankunding V

Good loan provider with competitive rates. They money immediately, as promised. I will use Citizens Bank again if I need extra money.

Jaqueline Lowe IV

Recently I experienced the most unexpected situation in my life. I suddenly needed $600 to pay for medical bills. This lender assisted me the same day. They were the only website that approved me for the required amount. I dealt with all my troubles. I will definitely recommend this website to my family. Best service in my life.

Pat Fadel

Important

The previous three items describe a precise lending service. But below you can find general information about payday loans.

Payday Loans in South Lyon, Michigan

A payday loan is a short-term loan that can help you cover emergency cash needs until you get your next paycheck. Available amounts usually range from $100 to $1,000.

Payday loans are the easiest loans to qualify for in South Lyon, Michigan. The entire process is fast. They are issued immediately and come with individual APR. It will be influenced by the borrower’s personal data.

369% APR*

600

Not Specified

31 days

Advantages of Citizens Bank that offers payday loans in South Lyon, Michigan

- Day and night service. This means you can submit an application from the comfort of your home. You won’t have to go anywhere to finalize your application or get money. The funds will be deposited to your bank account the same day or the next day.

- Collateral is not needed. You only need to meet the basic borrower requirements. You only need to provide some proof of income as well as valid identification. Bank statements and letter from employer are not needed.

- Application is purely online. It only takes several minutes to submit the form. The funds are transferred to your account as quickly as possible.

- 94% of applicants accepted. Almost all people are eligible for payday loans.

- Bad credit is ok. If you apply for a bank loan with poor credit, you are unlikely to get accepted. Banks only welcome good credit. Payday companies do not pay attention to your credit and previous mistakes. You are likely to get accepted in any case.

Information needed to complete a loan application

Then submit your online application to get an offer from one of financial institutions.

Payday loans for bad credit

If you have a bad credit rating you may still get approved for a payday loan. Such loans are designed to help meet the needs of individuals with lower credit scores. There are companies who may be happy to give you a payday loan even if you have a poor credit rating. You will need a regular income to apply for a bad credit payday loan.

To get approved for a cash advance, you need to meet the following requirements:

- be 18 years old or older;

- be a U.S. citizen or permanent resident;

- be employed and have a steady income;

- have a valid checking account in your name;

- have an email address and phone number.

Rate Your Credit Score

- No ability to get a loan

- No ability to rent a room

- 80% of loan approval

- Apply for all loan types

- 95% of loan approval

- Apply for all loans including mortgage

Other Payday Lenders in South Lyon, Michigan

First National Bank-St Ignace

132 N State St # 1, St Ignace, MI 49781, USA

+1 (906) 643-6800

www.fnbsi.com

PARDA Federal Credit Union - Main Office

2601 Cambridge Ct Suite 210, Auburn Hills, MI 48326, USA

+1 (800) 860-5640

www.parda.com

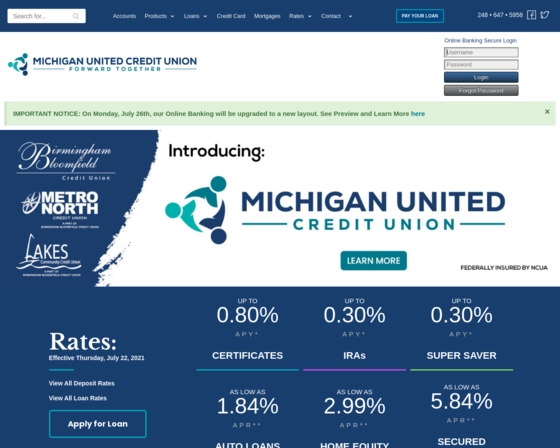

Birmingham-Bloomfield Credit Union

576 E Lincoln St, Birmingham, MI 48009, USA

+1 (248) 647-5958

www.bbcu.org