Domain Info

Feedback about Financial Aid Office?

Good service with a reasonable rate. Money deposited immediately, I always use Financial Aid Office.

Alvina McClure

Financial Aid Office is quite reliable, I will explain: the first loan, the limit is increased gradually. It is subject to repayment on due date. The employees in those customer care are adequate, they gave clear answers to my questions. There were no delays. And the rate is like everywhere else.

Danyka Wolff

I took out a payday loan when I had problems with money. There was no other way out. I searched this site on the Internet, among others. Has applied several services. One refused, the other offered too high a rate, but here it was approved as I wanted.

Dr. Rollin Nikolaus

I'm not ashamed to borrow money from Financial Aid Office, now the whole world lives like this. I have already used loans many times, everything is convenient.

Adelia Hilpert

It was necessary to improve the credit rating, because there is practically no chance of getting a cash advance at a good interest rate. As a result, I addressed Financial Aid Office. The score improved after several loans paid off.

Taurean Muller

Pay Attention

The first three points show the certain lender. In other turn, below-defined info makes users get acquainted common information about payday loans.

Payday Loans in Ann Arbor, Michigan

Payday loan is taken out for a short term: 2-3 weeks. The offered loan amounts are $100-$1,000.

Payday loans in Ann Arbor, Michigan are issued problem-free. The interest percentage is conditional on the borrower's person-related information: if you repay more payday loans, the more efficient terms and rates payday lending companies offer.

369% APR*

600

Not Specified

31 days

How will Financial Aid Office help issue a loan in Ann Arbor, Michigan?

- 24/7 service. Such Internet services allow you to get funds at any time. Money are issued day and night. The transfer will be sent to a bank account, so a personal visit to the office is not required.

- No paperwork. The list of required documentation is minimal. In most cases, an ID is needed. You do not need to provide a certificate of income.

- Online application. The application is filled in and processed much faster than in banks. Money is deposited within 24 hours after receiving approval.

- High approval rate. When it comes to small amounts, a positive decision comes up 98%.

- Availability. Banks provide loans at more stringent requirements on their clients. Age restrictions and bad credit will become barriers to issuing a loan. Lenders are more loyal to clients. The presence of minor delays and a bad credit does not guarantee rejection.

What data to fill in in the application? - General Info

After filling out an application, submit it and recieve the decision.

Payday loans for bad credit

If you are refused a loan at bank, the cause may be a bad credit history. This is a factor taken into account when deciding to issue a loan. Lenders do not consider this factor the only one to issue a loan in Ann Arbor, Michigan. The lending company will estimate many points to qualify such as financial capabilities. Cash advance will be a way to enhance your bad credit score into a favorable one.

The following general points will be estimated before applying for a cash advance:

- be at least 18 years old;

- be a U.S. citizen;

- be employed and have a reliable source of income;

- have a checking account;

- have a valid email address and phone number.

Rate Your Credit Score

- No way to issue a loan

- No ability to rent a room

- 80% of loan approval

- Apply for all loan types

- 95% of loan approval

- Apply for all loans incl. mortgage

Other Payday Lenders in Ann Arbor, Michigan

SAM Check Cashing

1525 S Opdyke Rd, Bloomfield Hills, MI 48304, USA

+1 (248) 335-7441

www.samco-financial.com

First National Bank & Trust

128 S Carpenter Ave, Kingsford, MI 49802, USA

+1 (906) 774-2200

www.fnbimk.com

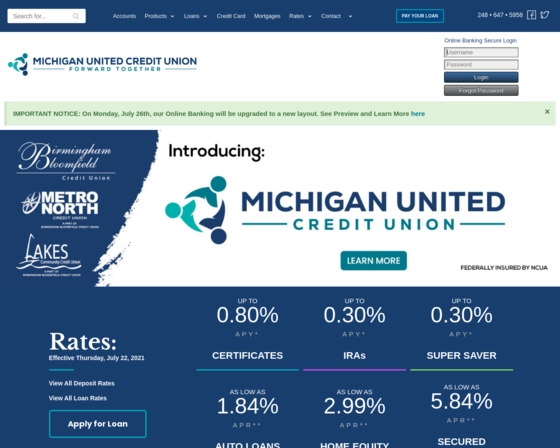

Metro North Credit Union A Part of Birmingham-Bloomfield Credit Union

15156 N Holly Rd, Holly, MI 48442, USA

+1 (248) 634-9061

bbcu.org

Frankenmuth Credit Union Mayville Branch

315 E Main St, Mayville, MI 48744, USA

+1 (989) 497-1600

www.frankenmuthcu.org

Advance America

6312 Dixie Hwy, Bridgeport Charter Township, MI 48722, USA

+1 (989) 746-0305

www.advanceamerica.net