Domain Info

Feedback about Simmons Bank?

I got the loan very fast

Dr. Ayden Pfeffer

This is by far the best loan experience I have ever had. Rise makes repayments affordable for any amount borrowed.

Amaya Padberg

You guys gave me a loan where others didnt. Thank you

Leone Fadel

Wouldn't give me change for a 20 because I didn't have an account there.

Delilah Heathcote

Very unprofessional.

Dr. Laron Hudson

I got the loan very fast

Dr. Ayden Pfeffer

This is by far the best loan experience I have ever had. Rise makes repayments affordable for any amount borrowed.

Amaya Padberg

You guys gave me a loan where others didnt. Thank you

Leone Fadel

Wouldn't give me change for a 20 because I didn't have an account there.

Delilah Heathcote

Very unprofessional.

Dr. Laron Hudson

I got the loan very fast

Dr. Ayden Pfeffer

Pay Attention

Payday lenders are provided in the first three points. Below info specifies common information about payday loans.

Payday Loans in Wichita, Kansas

A short-term loan is considered as a payday loan. This is a type of a financial product taken out for 2,3 weeks. Accessible loan amounts are from $100-$1,000.

Payday loans in Wichita, Kansas are issued problem-free. The interest rate is conditional on the client's personal data: if you repay more payday loans, the more favorable terms and rates payday lending companies offer.

391%*

$500

7 days

30 days

How will Simmons Bank help issue a payday loan in Wichita, Kansas?

- 24/7 operation. Such Internet services allow you to receive funds at any time. Funds are issued day and night. The transfer will be sent to a card, so a personal visit to the office is not required.

- No paperwork. The list of required documents is minimal. In most cases, an ID is needed. You do not need to send a certificate of income.

- Online application. The application is filled in and processed much faster than in banks. Money is deposited within 24 hours after receiving approval.

- High approval rate. When it comes to small amounts, a positive answer comes up 98%.

- Availability. Banks offer more stringent requirements on their clients. Age restrictions and bad credit will become barriers to taking out a loan. Payday lenders are more loyal to borrowers. The presence of minor delays and a low credit rating does not guarantee denial.

What data to fill out in the application? - General Info

Then press a Submit button to get an offer from one of the lending companies.

Payday loans for bad credit

One of the cause of refusal for a loan is a bad credit history. This factor is estimated by payday lenders before issuing a loan. But banks almost 100% deny the request when lenders in Wichita, ks will assess other aspects like financial capabilities and approve a payday loan. This is a way to improve your credit history.

The following general points will be rated before applying for a loan:

- be at least 18 years old;

- be a U.S. citizen;

- be employed and have a reliable source of income;

- have a checking account;

- have a valid email address and phone number.

Rate Your Credit Score

- No way to issue a loan

- No ability to rent a room

- 80% of loan approval

- Apply for all loan types

- 95% of loan approval

- Apply for all loans incl. mortgage

Other Payday Lenders in Wichita, Kansas

Central National Bank Drive Up ITM

1403 College Ave, Manhattan, KS 66502, USA

+1 (888) 262-5456

centralnational.com

Garden Plain State Bank

525 N Main St, Garden Plain, KS 67050, USA

+1 (316) 531-8800

www.gpsbank.com

First Option Bank Osawatomie

601 Main St, Osawatomie, KS 66064, USA

+1 (913) 557-0800

www.firstoptionbank.com

TitleMax Title Loans

600 N Ridge Rd Bldg 1, Wichita, KS 67212, USA

+1 (316) 215-8065

www.titlemax.com

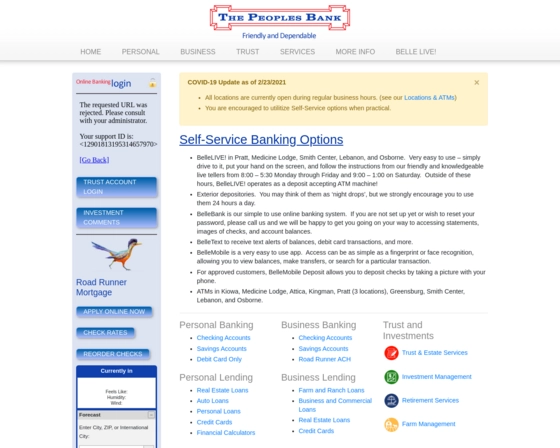

The Peoples Bank Loan Production Office

435 N Main St, Kingman, KS 67068, USA

+1 (620) 955-6118

www.bellebank.com

American State Bank & Trust Company

1404 28th St, Belleville, KS 66935, USA

+1 (800) 805-4649

www.asbt.bank